By 2021, spending on blockchain is expected to reach $9.2 billion, the report said.

Last year was considered a year of experimentations for the still-evolving technology, when businesses came to see both its benefits and the challenges it still must overcome, according to IDC. That means 2018 a crucial year for enterprises as they move from proof-of-concept projects to full blockchain deployments, according to Stacey Soohoo, IDC's research manager for Customer Insights & Analysis.

The industries expected to see the fastest growth in blockchain spending will be professional services, discrete manufacturing, and the resource industries. All are likely to show a better than 83% combined annual growth rate. Financial services leads the way Driven by banking industry adoption, financial services is expected to lead spending in the U.S. with $754 million this year. Other industries, such as distribution and the services market, are expected to spend $510 million, with manufacturing and the resources sector spending as much as $410 million this year. IT services and business services will account for about 75% of all blockchain spending throughout the year fairly. Blockchain platform software will be the largest category of spending outside of the services category and one of the fastest growing categories overall, along with security software.

"The U.S. will look to improve efficiencies in existing operations while promoting new applications in others, creating new streams of revenue and areas of spend," Soohoo said in a statement. "With increased investments driven by pressures to keep up with the accelerating pace in innovation, the world will continue to look to the U.S. for guidance as other regions forge ahead in their own blockchain projects and initiatives." Blockchain lends itself to a number of common use cases in the financial services market, including regulatory compliance, cross-border payments & settlements, custody and asset tracking, and trade finance and post-trade/transaction settlements, according to IDC. In the distribution and services sector and the manufacturing and resources sectors, the leading use cases include asset and goods management and lot lineage and provenance. Cross-border payments & settlements will see the largest spending in 2018 ($242 million), followed by lot/lineage provenance ($202 million) and trade finance & post-trade/transaction settlements ($199 million). These three use cases will remain the largest in terms of overall spending in 2021 as well, according to the report.

Votality Ahead?

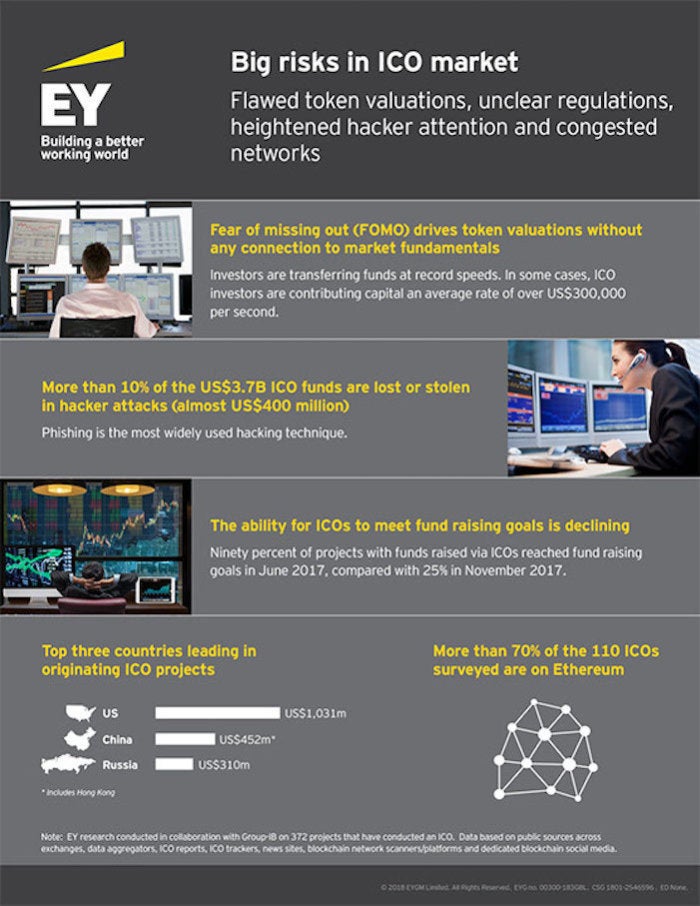

One problem that may affect blockchain is its crowdfunding component – cryptocurrencies such as bitcoin and initial coin offerings (ICOs). ICOs are a method of funding blockchain projects through the sale of virtual digital currency, such as Ethereum's Ether. Cryptocurrencies lack traditional backing, like that of fiat-based currencies created by governments, and initial public offerings (IPOs) that most often have some form of corporate equity behind them. A lack of fundamental valuation and the due diligence process by potential investors is leading to extreme volatility in the initial coin offering (ICO) market, according to new research published by Ernst & Young (EY). The research also found that in some cases ICO investors are contributing capital at an average rate of over $300,000 per second. EY studied 372 ICOs around the world, and discovered they raised $3.7 billion in funds, twice the volume of venture capital investments in blockchain projects. The U.S. is leading the ICO race, accounting for more than $1 billion in 2017. Russia and China followed with $300 million in ICOs each. "As ICOs continue to gain popularity and leading players emerge globally, there is a risk of having the market swamped with quantity over quality of investments," said Paul Brody, EY Global Innovation Blockchain Leader. "These high-risk investments and the complexity of ICOs need to be managed to ensure their credibility as a means of raising capital for companies, entrepreneurs and investors alike." EY found there may be no business need for many of the utility tokens, which are essentially a form of application-specific currency that blend the technology features of blockchains with a speculative component for investors where the tokens' value will rise as usage increases, according to EY. "In fact, most ICO white papers lack a clear explanation of the business reasons for blockchain and token currency," EY said. "In most cases, there is no need for an application-specific exchange token. The core technologies and benefits of blockchain technologies can be applied to business operations without having to use proprietary digital currencies." Security concerns and government oversight ICO investors also face other risks: theft from hacking and increased regulatory oversight, according to EY. For example, cryptocurrencies have begun to exit once-friendly China for more open nations even as other regions and businesses begin to impose restrictions on how – or even whether – they can be used.Security concerns and government oversight

ICO investors also face other risks: theft from hacking and increased regulatory oversight, according to EY. For example, cryptocurrencies have begun to exit once-friendly China for more open nations even as other regions and businesses begin to impose restrictions on how – or even whether – they can be used.

Open blockchains, such as bitcoin, are only the first to be affected by more stringent regulatory oversight. Depending on how they're used, permissioned blockchains – those that are centrally administered and used for general transactions – could also be affected by the push to reign in the cryptocurrency technology. There are various "good" reasons China and other countries hope to take a more hands-on regulatory approach to cryptocurrencies, which to date have existed in an oversight Wild West, according to Martha Bennett, a principal analyst at Forrester Research. There are several regulatory aspects to consider, including oversight of cryptocurrencies and ICOs, "which are increasingly drawing the attention of regulators," Bennett said. "That’s a good sign; while it’ll have a deflationary [effect], it’s also needed for investor protection and to avoid systemic risk." There is a growing concern that cryptocurrency could be a threat to the current financial system through unbridled speculation and unsecured borrowing by consumers looking to purchase the virtual money. "We have seen increasing evidence that people are borrowing to invest in cryptocurrencies, and in some cases borrowing on credit cards to invest in it," Bennett said. "That could lead to a credit collapse." Theft from hacking has also been an ongoing problem. More than 10% of ICO funds are lost or stolen in hacker attacks, which amount to about $400 million, according to EY's study. "Hackers benefit from the hype, irreversibility of blockchain-based transactions and basic coding errors that, had the ICO been carefully reviewed by experienced developers and cybersecurity analysts, could have been avoided," the report said. The price of the leading cryptocurrency, bitcoin, has skyrocketed to nearly $20,000 in recent weeks only to plunge to under $10,000 before recovering to $11,000 today. The second most popular cryptocurrency, Ethereum's Ether, also saw its price jump over the past month from $481 to more than $1,300. It's currently at $1,059.

Ripple, a blockchain-based financial settlement and currency exchange system, also has its own form of cryptocurrency: XRP, which banks on the network can chose to use as an intermediary between cross border currencies or not. Because of the recent investment fervor around virtual currencies, XRP's market price has also risen dramatically.

0 comments: